MetaTrader 5 MT5 is a powerful and widely used trading platform offering comprehensive features, tools, and advanced functionality for traders in various financial markets. Developed by MetaQuotes Software Corp., MT5 builds upon the success of its predecessor, MetaTrader 4, and provides an enhanced trading experience for both novice and experienced traders. In this article, we will take a deep dive into the features, tools, and advanced functionality of MT5, exploring how it can empower traders to make informed decisions and execute trades effectively.

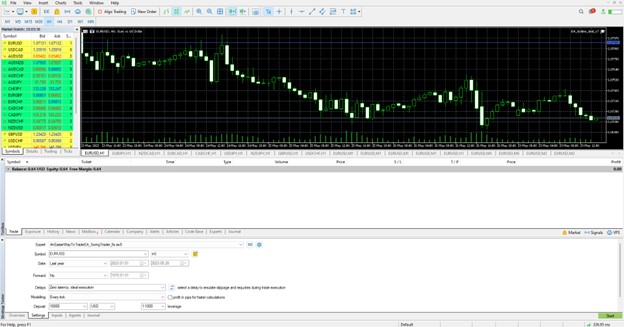

I. Overview of MetaTrader 5

Image 1. A general view of the MT5 platform.

A. Brief history and evolution of the platform:

MetaTrader 5, released in 2010, represents a significant advancement from its predecessor, MetaTrader 4 (MT4). While MT4 primarily focused on Forex trading, MT5 expanded its scope to include multiple asset classes such as stocks, futures, and commodities. This evolution allowed traders to access a broader range of markets and instruments, enhancing their trading opportunities.

B. Supported financial markets and instruments:

The platform supports an extensive range of financial markets, including Forex, stocks, commodities, cryptocurrencies, and futures. Traders can access multiple exchanges and trade various instruments within these markets, such as currency pairs, company shares, precious metals, energies, and more. The platform's multi-asset capabilities enable traders to diversify their portfolios and explore different market opportunities from a single interface.

C. Multi-asset capabilities:

Traders can trade Forex, stocks, commodities, and other instruments from a single trading account on MT5. This feature allows for efficient portfolio management and enables traders to take advantage of correlations and opportunities across different markets. Whether you prefer to focus on a specific asset class or engage in diversified trading strategies, MT5's multi-asset capabilities provide the flexibility to adapt to various market conditions and trading preferences.

II. User Interface and Customization Options

Image 2. Available chart customization options in the toolbar.

A. Intuitive interface design:

MetaTrader 5 boasts a user-friendly interface that is both intuitive and customizable. The platform's layout is designed to provide easy access to essential trading functions, including charting tools, order placement, and account information. Traders can navigate the platform effortlessly, even if they are new to MetaTrader. The clean and organized design ensures that critical information and features are readily available, promoting a smooth trading experience.

B. Charting and analysis tools:

The platform includes a wide range of technical indicators, oscillators, and drawing tools, enabling traders to conduct detailed technical analysis. Additionally, MT5 supports multiple chart types and timeframes, facilitating various trading strategies and time-based analysis. Traders can customize charts to suit their preferences and save their preferred chart layouts for easy access.

C. Customizable layouts and profiles:

Users can create multiple profiles with different settings and layouts, making switching between various trading strategies or asset classes convenient. The platform enables traders to arrange and organize the interface's windows, indicators, and other elements, ensuring a personalized and efficient workspace. Whether you prefer a minimalist setup or a complex layout with multiple charts and tools, MT5 offers the flexibility to adapt to your unique trading style.

III. Trading Execution and Order Management

Image 3. Order window at MT5.

A. Market, limit, and stop orders:

Various order types, including market orders, limit orders, and stop orders, are supported on the platform. Market orders are executed instantly at the prevailing market price, while limit orders allow traders to specify their desired entry or exit price. Stop orders, including stop-loss and take-profit orders, are crucial for managing risk and securing profits. With these order types, traders can enter and exit positions precisely according to their trading strategies, enhancing their control over trade execution.

B. Partial order filling and execution modes:

MetaTrader 5 offers advanced order execution modes to give traders flexibility and control over their trades. The platform supports partial order filling, where orders can be filled in multiple increments, ensuring optimal execution even for large orders. Traders can choose from various execution modes, including Instant Execution, Request Execution , Market Execution, and Exchange Execution, depending on their specific trading needs and the characteristics of the financial instruments they are trading. These execution modes allow traders to align their trading style with the most suitable order execution method, ensuring efficient and timely trade execution.

C. Trade management tools:

Traders can easily modify and adjust existing orders, set up trailing stops to protect profits, and implement breakeven levels to secure their positions. The platform also offers advanced features such as one-click trading, enabling swift order placement and execution. With these trade management tools, traders can effectively manage their risk, maximize their profits, and adapt to changing market conditions.

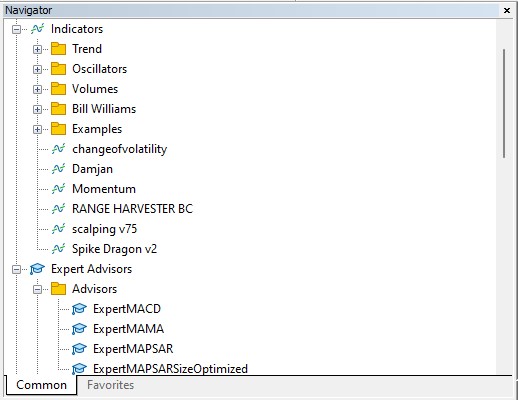

IV. Technical Analysis Tools

Image 4. The navigator section of MT5 holds all the indicators and experts.

A. Extensive range of indicators and oscillators:

From simple moving averages to complex indicators like the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD), traders have access to powerful tools to identify trends, measure market momentum, and spot potential entry and exit points. Additionally, MT5 supports custom indicator development, allowing traders to create and integrate their own unique indicators into the platform.

B. Charting styles and timeframes:

MT5 provides a variety of charting styles, including line charts, bar charts, and candlestick charts. Traders can choose the style that suits their preference and trading strategy. Moreover, the platform supports multiple timeframes, ranging from seconds to months, enabling traders to analyze price movements and patterns across different time intervals. This flexibility in charting styles and timeframes empowers traders to gain deeper insights into market dynamics and make well-informed trading decisions.

C. Backtesting and strategy optimization capabilities:

Another notable feature of MT5 is its built-in strategy tester, which allows traders to backtest their trading strategies using historical market data. By simulating trades based on past market conditions, traders can evaluate the performance of their strategies and make necessary adjustments.

Additionally, MT5 provides optimization tools that help traders fine-tune their strategies by testing different parameter combinations. These backtesting and strategy optimization capabilities assist traders in developing and refining their trading approaches with confidence.

No comments:

Post a Comment

Please Leave a Comment to show some Love ~ Thanks